But that’s not Meta’s only problem. Privacy policy and regulatory trends are also impacting ad sales revenue forecasts. And Apple Inc.’s recent move to allow users of its devices to block apps from tracking their online activities is jeopardizing the flow of data to Facebook which allows it’s algorithm to accurately target ads to users based on their interests. As Meta’s user data becomes increasingly “stale”, advertisers could become increasingly wary about the reliability of the platform’s targeting algorithms. David Wehner, Meta’s chief financial officer hinted at this in Meta’s latest earnings call, “We anticipate modestly increasing ad targeting and measurement headwinds from platform and regulatory changes.” Sources of incremental growth it appears, are increasingly difficult to find for the publicly traded behemoth. This all comes on the heels of the decision to eliminate third-party ad cookies in the Chrome browser by Alphabet by late 2023.

These macro trends in combination spell nothing less than a complete reset of the digital ad universe. Let’s address each of these macro trends and their impact on the future outlook for marketeers as they reshape the advertising landscape.

Increasing User Fatigue at Advertising Platforms with Big Reach

The demise of the traditional media landscape (network TV, radio, outdoor etc.) has driven marketers increasingly to digital platforms for reach. The ability to measure ad campaign effectiveness in digital vs offline environments and the improved ROI these campaigns demonstrated further propelled this shift. Ad dollars flowed to the networks with the greatest user audiences.

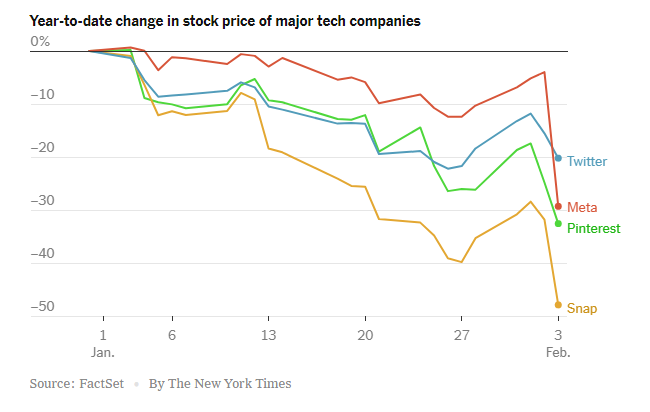

But over the last decade, for every launch and splash of the Tik Toks and Snapchats, there has been some cannibalization of existing social media platforms’ user bases. I believe, as the more mainstream platforms have extended themselves past their original value propositions to include broader “use cases” and expand their market reach, they may have diluted their value to users. I have seen this happen in other industries where in a mad dash toward growth, brands become “one of many” in growth-focused commercial enterprises, eventually suffering erosion in brand equity and loyalty among consumers. Think GAP. Yahoo. These brands still exist, but they are one of many now and have been buried by the competition.

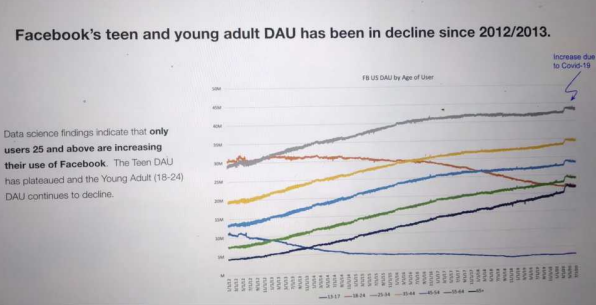

There is growing evidence (based on internal Facebook documents leaked by data scientist and whistleblower Frances Haugen in Fall 2021) that teen and young adult users are declining at Facebook and have been since 2012-2013.

Other qualitative research has uncovered that these users tend to view Meta/Facebook and Twitter as cluttered, less relevant and less ethical given the spread of misinformation/bad actors now associated with these platforms. Even golden goose Instagram has come under fire for creating negative self-image effects on young girls.

While an increasing focus on AI/VR, new features (from crypto payments, NFTs to branded Bitmoji characters) and e-commerce and other monetization strategies etc. may bolster engagement and revenue streams at these platforms, user disaffection is a major red flag for a publicly traded player dependent on an ad sales business model. And the possibility of regulatory breakup of the Metas due to antitrust concerns, could make this an even more worrisome concern for the larger platforms.

More Stringent Privacy Regulations

Data hacks are on the rise and with them is an even stronger push for more stringent privacy protections for consumers. Employers are increasingly concerned about legal liability risks associated with customer/client/user data hacks of stored company data. Disinformation campaigns fueled by social media algorithms have also heightened focus on the importance of data protections nationally and internationally. And with the pandemic, the advent of remote work has further exacerbated concerns about data safeguards. “Data scientist” is one of the hottest job titles on the leaderboards of recruitment meccas.

In the U.S., we have historically operated under a patchwork of state privacy laws and sector-specific legislation, including the Health Insurance Portability and Accountability Act (HIPAA) (for health data), the Gramm-Leach-Bliley Act (for financial data), and the Family Educational Rights and Privacy Act of 1974 (to protect student data). Now there is broader interest in a GDPR-inspired Federal Privacy Law.

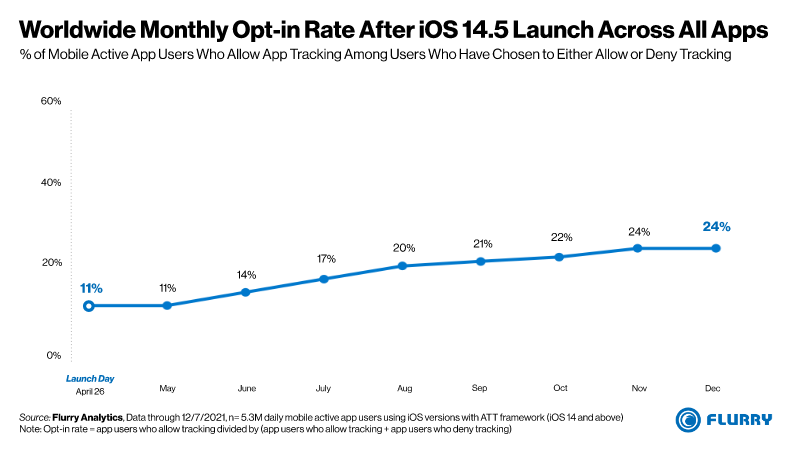

Changing App User Privacy Protections

In April 2021, Apple announced that with the launch of their latest operating system version IOS 14.5, their App Tracking Transparency (ATT) policy would go into effect for all apps requesting inclusion in the app store after April 26, 2021. ATT requires users to opt in formally to data tracking by third party apps they download to their devices. When users open any app that wants to access a device ID called the Identifier for Advertisers, or IDFA, they will automatically receive a pop-up asking them to opt-in or opt-out of data sharing with the app. Note that apps already in the app store or installed on user devices prior to April 2021 are excluded from this requirement. Research about how consumers are responding to the ATT opt-in campaign indicate a strong rate of adoption to date, hovering around 76% of them opting in to disallow apps from collecting personal data:

The Demise of 3rd Party Cookies for User Tracking

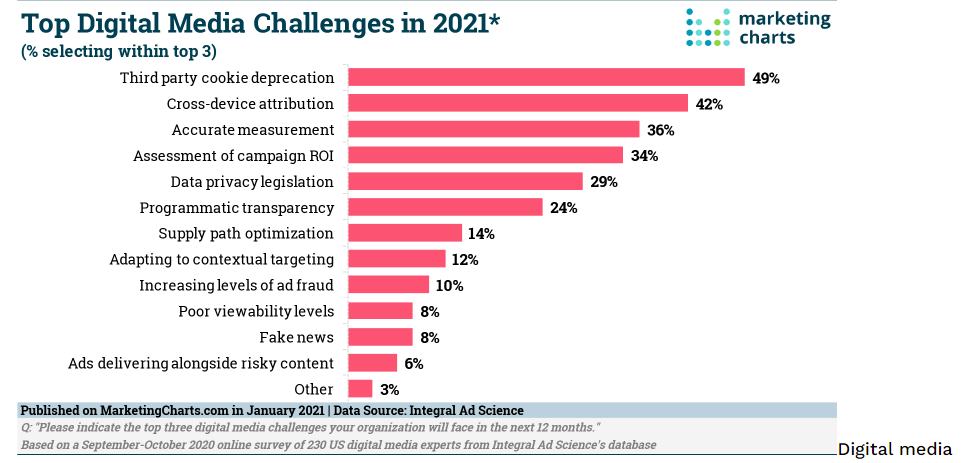

A year ago, a survey of digital marketers by Integral Ad Science revealed that third party cookie deprecation was the issue of greatest concern to advertisers. Concerns about privacy intrusions have increased industry focus on the use of cookies to track user interests and online behavior. Data Protection Authorities (DPAs) globally have issued new and updated guidelines regarding the use of cookies and prioritized enforcement of cookie policies. And there is a growing trend toward class-action lawsuits for cookie violations (e.g. Oracle and Salesforce).

In 2019 and 2020, Mozilla’s Firefox and Apple’s Safari browsers began blocking third-party cookies by default. And Alphabet (Google’s parent company) announced that the company will end cookie use in the Chrome browser sometime in late 2023.

Marketers are worried about what the demise of cookies will do to their ability to target ads effectively. According to Marketing Charts research conducted in October 2021, most senior marketers are fearing the worst when it comes to cookies become obsolete later in 2023:

- Half (51%) of the 500 US senior marketers surveyed say that third-party cookies are very important and make up a majority of the data in their companies.

- (84%) of marketers surveyed are worried about the future of advertising as third-party cookies are phased out, with more than one-third (35%) believing it will adversely impact targeting and measurement.

So, what do these privacy, regulatory, feature and policy changes imply for the future of digital advertising?

More fragmentation of the landscape. Google and Amazon win on the battlefield. More regulation and restrictions. Reduced efficiency in ad targeting. More reliance on search-based advertising. In summary, it’s going to get harder, more technical, and more expensive.